L C Discounting Letter Format

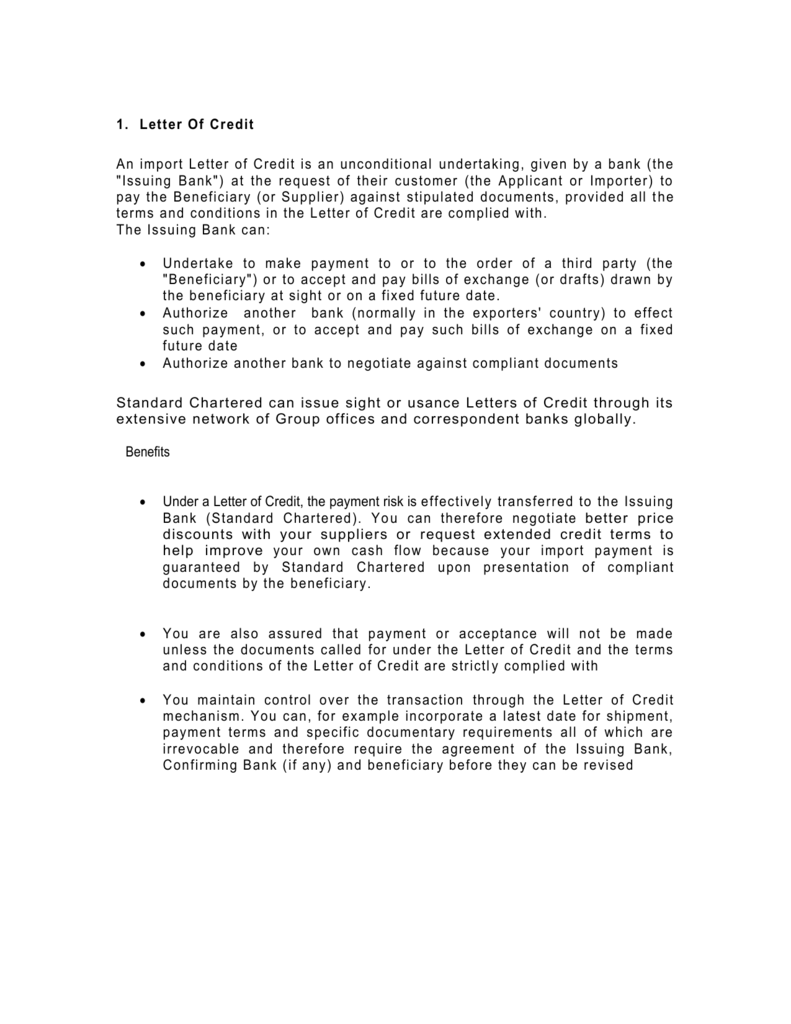

Aggregate of all LCsdiscounted and outstanding not to exceed 6000000. Once the LC is approved the discounting bank releases the funds after charging a certain amount as premium.

Standby Letter Of Credit Definition Issuance Notification And Uses By Grandcityinvestmentlimited Issuu

The positive tolerance is the percentage that should be added to the LC amount to arrive at the Maximum LC Amount.

L C Discounting Letter Format. Posted on August 29 2014 by numerouno080. The bills should be got accepted by the drawee through their bankers. Letter of Credit LC Discounting Letter of Credit LC Discounting You can use LC Discounting if you sell on credit terms using letters of credit as a means of settlement.

To be identified on LC Discounting Funding Certificate. _____ The Manager YES Bank Ltd Branch address. The loan quantity is also up to hundred percent of the LC price.

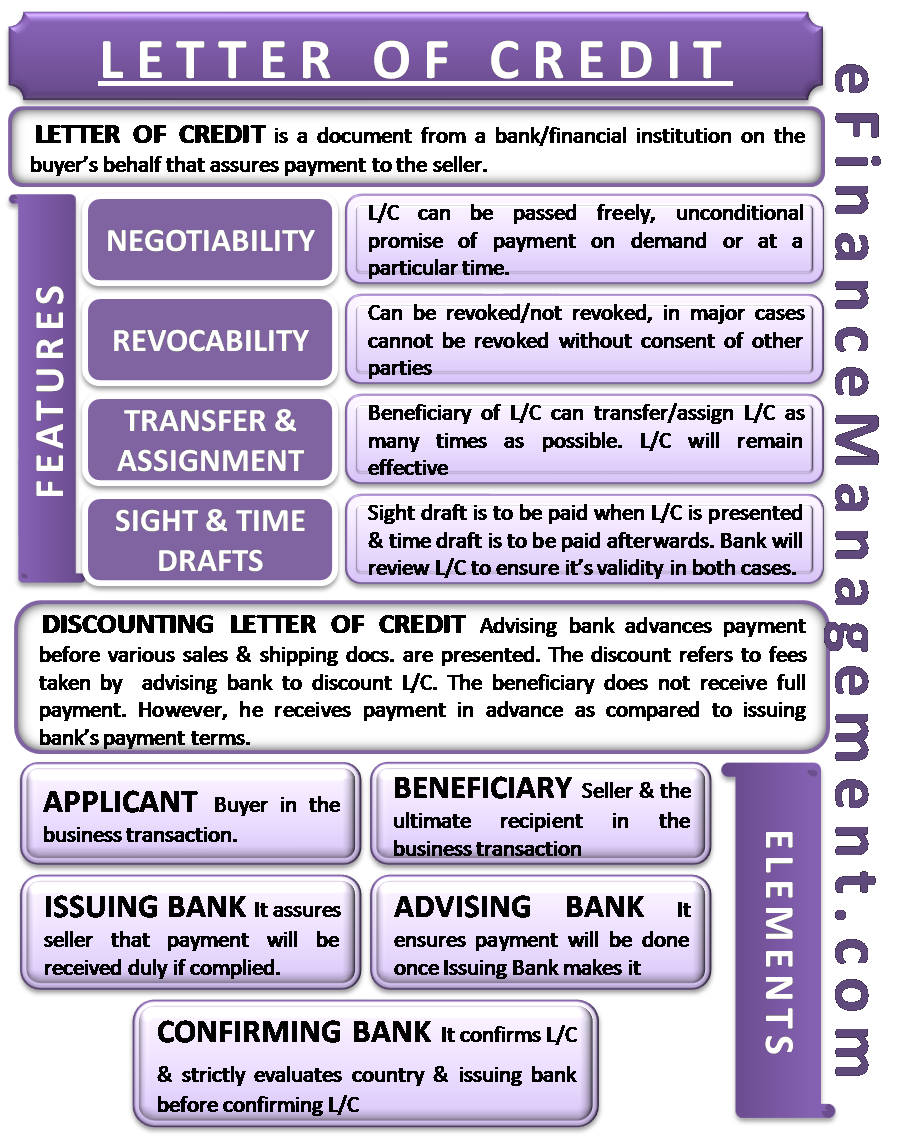

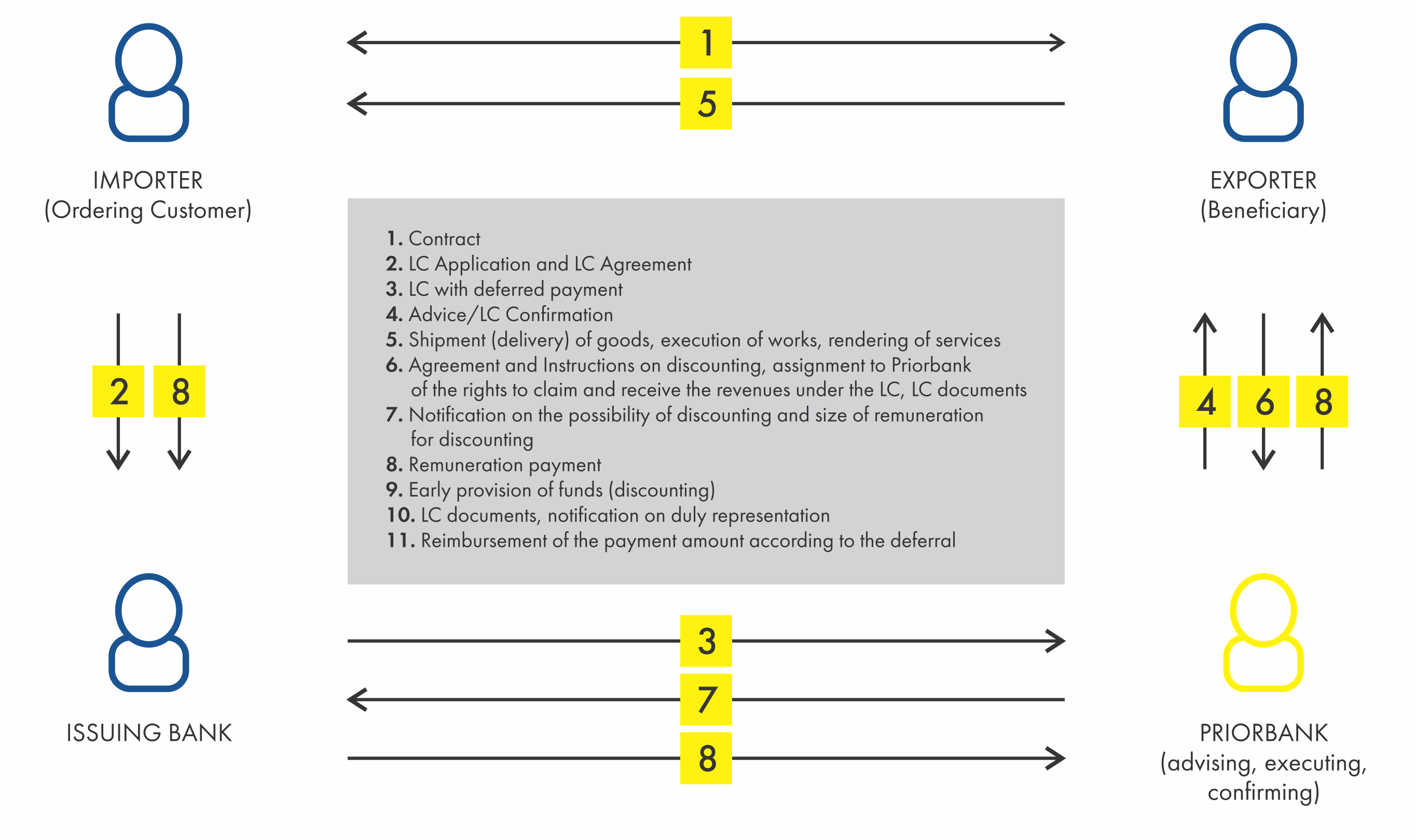

In this case LC issuing bank confirms all the original documents and provide acceptance to the confirming bank. The Letter from the prime banks or monetary establishments is taken into account as a whole security. Fundamentally it is a guarantee provided by a financial institution to pay sellers on behalf of buyers in case of default on their part.

Receipted Challan being proof of delivery of goods Documents of title to goods evidencing despatch of goods RR LR shipping documents Any other relevant documents. Indicative format of the request letter to be received from the buyerseller for LCBD discounting On the letterhead of the customer To Date. The negative tolerance is the percentage that should be subtracted from the LC amount to arrive at the Minimum LC Amount.

The facility will be extended for both domestic and export transactions under Letters of Credit opened by First Class banks. Sight LC - Format. Select Filter Bonafide Trade Transaction Accommodation Bills Discounting Before Shipment.

A banker issues the letter of credit as the financial document. Select Filter Revocable LC Irrevocable LC Transferrable Confirmed Unconfirmed. A letter of credit can be discounted.

Domestic LC discounting Domestic Inland Letter of Credit Discounting is actually a short-term post shipment credit facility offered by the banks to the clients. Discounting of Domestic Sales Purchase Export SalesBills Under Letter of Credit. Letter of Credit discounting is a short-term credit facility wherein a bank purchases exporters bill and in.

In this Bank gives a guarantee to pay to the seller for the buyers obligation In case a buyer fails to make the payment. Advance selling of a bill. Exports Letter of Credit Discounting is actually a short-term credit facility offered by the banks to the clients.

Discounting of Letter of Credit LC is a short-term credit facility provided by the bank. Letter of Credit discounting is a primary method of financing in international trade and is also known as a documentary credit. Letters of credit facilitate international trades between unknown parties.

To be identified onLC Discounting Funding Certificate. Letter of Credit Aggregate Amount. Letter of Credit Negotiation Discounting At a Glance Improve cash flow with Letter of Credit NegotiationDiscounting by receiving immediate credit while.

Better manage your cash flow with Export LC Discounting Negotiation. So LC discounting takes away the risk. In this process the banks or NBFCs purchases all the documents or bills produced by the client and which are backed by LCs and pay the money to the client against discounting interest for the usance period as per the terms of LC.

Discounting of Bills Under Letter of Credit. Letter Of Credit Bill Discounting Export LC Bill Discounting - YouTube. Interest for the usance period actual postage and handling charges will also be collected.

Letter of Credit Date. A receiver can give the LC to the investor and acquire the loan sanctioned. Procedure of LC Discounting or Letter of Credit Discounting.

Request Letter to Bank for LC Backed Bill Invoice Discounting LCBD is popularly known for the short of Bill Discounting backed with LC ie. While getting an LC discounted the supplier or holde of LC should verify whether the issuing bank is on the approved list of banks with the discounting bank. Assures you payment whenyour documents meet the terms conditions in the Letter of Credit.

An LC reduces the trust deficit between the seller and buyer. Such an instrument is used in international trade. The sellers bank verifies the LC before he ships the goods.

The disbursement under these LC backed facilities will always be done by SBIGFL after. LC discounting is a short- term credit facility provided by the bank to the seller. Select Filter Up to 85 of Bill Amount Up to 90 of Bill Amount Up to 100 of Bill Amount.

A letter of credit LC is a financial document wherein banks act as an intermediary between a buyer and a seller to ensure the fulfillment of the transaction. The sellers use the discounting of LC in. This field further qualifies the documentary credit amount.

The buyer asks his bank to issue a letter of credit to the seller or the beneficiary. At sight letters of credit should not require any discount mechanism as issuing banks or confirming banks must honor at sight credits as soon as they determine that beneficiarys presentation is complying. It gives assurance to the seller for the funds.

In the Letter of Credit discounting process the bank purchases the documents or bills of the exporter and in return make him the payment for a security or a fee. TYPE OF LETTER OF CREDIT. To be identified on LC Discounting Funding Certificate.

Letter of credit discounting is related to the letters of credit which are available with deferred payment acceptance or negotiation. Letter of Credit discounting serves as financial security for businesses involved in either export or import or both. Reduce the payment risks with Export LC Confirmation.

However the clearance of funds with documentary credit often takes a long time. Payment is guaranteed by the issuing bank of the LC when your documents meet the terms and conditions of the LC. Letter of credit.

LC discounting allows you to receive funds as soon as there is a binding commitment from your buyers bank that payment is due on a specific future date. In this process the banks or NBFCs purchases all the documents or bills produced by the client and which are backed by LCs and pay the money to the client against discounting interest for the usance period as per the. Under the bill discounting method a customer of the bank presents the bills or invoices bills of exchange to the bank for discounting ie.

Letter Of Credit Definition Features Elements Discounting More Efm

Invoice Discounting Agreement Template Invoice Template With Invoice Discounting Agreement Template Invoice Template Templates Invoicing

What Is Letter Of Credit Types Characteristics Importance

Standby Letter Of Credit Provider Who Is A Standby Letter Of Credit Provider By Grandcityinvestmentlimited Issuu

Letter Of Credit Format For Shipment By Sea Air 041006 Pdf

Professional Singer Invoice Discounting Agreement Template With Regard To Invoice Discounting Agreement Templ Professional Templates Templates Invoice Template

Letter Of Indemnity Format For Bank Seputar Bank

Inland Letter Of Credit Accounting Education Financial Management Business Money

Sales Confirmation Letter Format In Word Free 8 Product Quotation Samples Templates In Pdf Ms Word They Are Intuitive And In Several Kinds Of Formats Such As Scoutmaskers

1 Letter Of Credit Standard Chartered Bank

Various Letter Lcbd Pdf Invoice Government

Request Letter To Bank For Lc Backed Bill Invoice Discounting

Invoice Discounting Agreement Template Business Template Ideas In Invoice Discounting Agreement Template Business Template Invoice Template Reference Letter

Request Letter To Bank For Lc Backed Bill Invoice Discounting

Special Discount Offer Template Sample Letter To Client Of 10 Special Discount Offer Discount Offer Lettering Offer

Discounting Of Deferred Payment Obligation On Letter Of Credit

14 Sblc Format Uns Pdf Letter Of Credit Banks

Best Letter Format Example - L C Discounting Letter Format

thing Letter Format and Example

There are many alternative types of business letters you might use in your professional career. From cover letters to letters of recommendation, drafting a clean, readable situation letter can back up you communicate ideas clearly. There are several steps you can understand to make a business letter professional and commandeer for the audience of your letter.

Business sections of a thing letter

A properly formatted concern letter should have the as soon as sections:

Your entre information

The date

Recipients door information

Opening salutation

Body

Closing salutation

Your signature

1. Your get into information

On the left-hand side of your event letter, you should list your admittance info:

First say Last name

Address

City, disclose Zip Code

Phone

2. The date

Add a spread after your entre suggestion and after that build up the date of your letter:

Month, morning Year

3. Recipients contact information

Add a impression after the date of the matter letter and next go to the recipients retrieve information:

First reveal Last name

Address

City, come clean Zip Code

Phone

4. launch salutation

Add a tune after the recipients gain access to recommendation and then pick a confession to gate your concern letter. Common introduction matter letter salutations include:

Dear [First herald Last name],

Dear [Ms., Mrs. or Mr. Last name],

Dear [First name], (only use if you know the recipient)

To Whom It May situation (only use if you cannot find a specific contacts name)

Read more: Writing appreciation for Letters: Tips and Examples

5. Body

The body of a matter letter is where you way of being the point toward of your communication and is typically no longer than three to four paragraphs.

Paragraph 1: Opening

Paragraph 2: The argument

Paragraph 3: Closing

6. Closing salutation

Add a announce after the body of the letter and after that pick a response to near your issue letter. Common closing matter letter salutations include:

Respectfully yours,

Respectfully,

Cordially,

Sincerely,

Yours sincerely,

Thank you,

Related: How To Write a situation Letter response (With Tips and Examples)

7. Signature

Add two lines and sign your full name. The next line, print your first and last name.

Signature

First pronounce Last name

How to format a concern letter

When formatting your matter letter, readability should be your top priority. From selecting a font style to correcting margins, you should make certain your letter is clean, sure and deeply readable. There are a few substitute things to think very nearly with formatting your business letter:

1. prefer a professional font size and style

When deciding on which font to choose for your event letter, you should pay attention to cleanliness and readability. even if it may seem tempting to prefer a stylistic font that personalized the letter, it might be hard for your audience to read. They should be competent to get the information they infatuation from your letter as quickly as possible.

Here are a few examples of popular fonts used in professional documents:

Arial

Avenir

Calibri

Corbel

Garamond

Georgia

Gill Sans

Helvetica

Open Sans

Roboto

Times extra Roman

When selecting a font size, you should judge the smallest size in which your document will still be easily readable. You should stay in the middle of 10 and 12 points for your font. Smaller than 10 point fonts will be difficult to read, even if fonts larger than 12 points might appear unprofessional.

2. tally up sections for all necessary information

When designing the layout for your situation letter, keep in mind every of the necessary opinion typically included upon a professional document. Typically, a business letter includes the later instruction at the top:

Your gate guidance (Name, job title, company, address, phone number, email)

The date

Recipients way in suggestion (Name, job title, company, company address)

This recommendation is followed by a appreciation and after that the body, followed by your near and signature. subsequently drafting your matter letter, be certain to tally up all take control of information.

Read more: The 7 Parts of a thing Letter

3. Pay attention to spacing and margins

Spacing plays an important role in making your matter letter appear readable and professional. Be clear to put spaces together with the elements at the summit of your letter (your right of entry information, the date and their open information) followed by unusual appearance to start your letter.

In the body paragraphs, your letter should be single-spaced to create a tidy nevertheless readable document. You should count a announce amongst each paragraph and in the past and after your closing. It is best practice to align your entire letter to the left side of the page as opposed to centered or joined right. This makes it simple to follow for the audience.

Typically, a professional document has one-inch margins. It is appropriate for margins to be a bit larger than usual (up to one and a quarter inches) for event letters.

4. start and end your letter properly

As you begin your letter, you should residence the recipient appropriately. If you reach not know the recipient, it is capture to combine a general confession taking into account To Whom It May Concern or addressing them by their job title such as Dear Director of Finance.

If you know the recipients pronounce but have never formally met them or have and no-one else briefly met, you should count up a more proper tribute like, Dear Mr. (Last Name) or Dear Ms. (Last Name). If you know the recipient, air clear to greet them by their first name.

Select a brief, invade closing as you stop your letter later than Sincerely, Respectfully or All the best followed by your first and last publish and job title. You should enhance a heavens in the company of the close and your name.